Core Strategy Preferred Approaches

Chapter 1: Location, Scale and Type of Major Development

Location Of New Housing

7.1 The Government sets 3 main tasks for local authorities when planning for housing land supply. In Hastings, we need to:

- Demonstrate how we can accommodate 4200 additional homes in the period 2006 – 2026 as set out in the draft South East Plan;

- Identify broad locations and specific sites that will enable continuous delivery of housing for at least 15 years from the date of adoption of the Local Development Framework and

- Show how we will manage housing land supply to ensure continuous delivery of new housing.

You Told Us – Results of Issues and Options Consultation

7.2 55% of respondents supported options that could accommodate to up to 20% more housing than indicated in the South East Plan, 38% did not, and 7% had no opinion.

7.3 There was a lot of support for making best use of previously developed land as a priority. The Home Builders’ Federation supported the greenfield option as this gave more flexibility to viably deliver new market and affordable housing and expressed concerns over the feasibility of developing difficult brownfield sites without some form of subsidy. Several respondents suggested the use of empty buildings for housing although we are not allowed to count the re-use of these in our housing provision figures.

7.4 There was recognition that we need a mix of housing sites and locations to accommodate skilled and professional newcomers to the town, as well as provide affordable housing. The need for close working with Rother District Council was emphasised in relation to Wilting and any developments on the town’s western edge.

The Preferred Approach – Location of New Housing

Meeting the Draft South East Plan target and Identification of broad locations/sites:

7.5 Since the publication of the Issues and Options consultation paper in October 2006, the Government has issued new guidance on the calculation of housing provision figures. A major change is that we are no longer automatically allowed to include in our calculations an allowance for ‘windfall’ provision, i.e. development coming forward on sites not identified in the Plan. These include small sites of 5 units or less, or units resulting from the conversion or subdivision of large properties. We have calculated that windfall provision could contribute up to 1520 new dwellings in the town in the period 2006 – 2026 (36% of the draft South East Plan target).

7.6 However, we can only include this figure if we can provide very strong evidence that all potential, deliverable housing sites have already been identified in a Strategic Housing Land Availability Assessment. We consider this to be a high risk strategy as it opens up the possibility that the plan may be found ‘unsound’, if the Inspector does not feel that our site identification has been sufficiently rigorous, or disagrees about the delivery potential of more marginal sites.

7.7 In the light of this, we have looked at 4 options for housing delivery, which do not include an allowance for unidentified ‘windfall’ sites.

| Option |

Net number of dwellings 2006 - 2026 |

|

| 1 | Development wholly within the boundary of the built up area | 3966 |

| 2 | Development within the built-up area plus green field sites on the urban periphery | 4240 |

| 3 | Development within the built up area boundary plus release of one major green field site in the northwest of the town | 4966 |

| 4 | Development within the built up area boundary plus Greenfield sites on the periphery, plus release of one major green field site in the northwest of the town | 5240 |

7.8 Option 1 has been discounted as it fails to meet the South East Plan target of 4200 dwellings. Option 2 has also been discounted as it only just meets the target, and does not provide enough flexibility if sites do not come forward at the expected rate.

(60) PREFERRED APPROACH 1: Location of New Housing

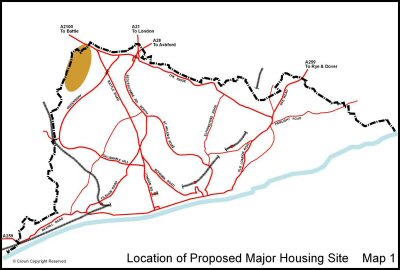

To meet the draft South East Plan housing requirements of 4,200 net new dwellings between 2006 and 2026, the Council will take forward Option 3, and direct development within the built-up area, plus release of one major Greenfield site at Breadsell Lane in the northwest of the Borough (see map 1).

The Sustainability Appraisal has indicated that the development would be more sustainable if it included an element of employment use (up to 10,000m²) and provision of community facilities such as neighbourhood shops and good public transport provision. There is also potential for on-site renewable energy provision and homes to be designed to environmental standards which are higher than the general standards set in Preferred Approach 44: Sustainability and Design.

Access to the site would be through land in Rother District and this will be reflected in the Rother LDF. ESCC as the Local Education Authority, has indicated that there may well be the need for a new primary school in the north west of the town after 2021, should this development take place. However, the need for a new school will depend on whether schools in adjoining areas can provide or be expanded to provide accommodation. This in turn, is dependent upon the rate of house building in this and other parts of the town.

This position will be carefully monitored and will be kept under review by the Borough Council and the County Council over the plan period. The detailed planning of this area will be guided by a Supplementary Planning Document to be prepared alongside the Site Allocations DPD.

7.9 Sustainability Appraisal has demonstrated that option 3 is preferable to option 4 in terms of providing more opportunity for essential infrastructure to be provided on site, such as improved transport, community and recreational facilities, which would not always be provided on smaller individual sites. A larger single site may also enable us to require higher standards of sustainable design and construction, ensuring increased levels of energy efficiency and on site energy generation, subject to further evidence gathering.

7.10 Options 3 and 4 relate well to the “Country Avenue Concept” proposed in the “Towards a Masterplan Hastings & Bexhill” document. A key aspect of this concept was mixed use development of homes and compatible employment space. Development would avoid ancient woodland and Sites of Special Scientific Interest (SSSI).

7.11 In addition, it is important to note that option 4 would result in the town performing worse in meeting the national target for development on brownfield sites. However option 4 should not be ruled out completely at this stage. Until the South East Plan is adopted, final housing numbers for Hastings will not be confirmed, and option 4 may be required if housing numbers are increased.

7.12 The table below shows the different elements of land supply from 2006 up to 2026, which are included in this Option 3.

| Type of land | Net number of dwellings | % on previously developed land | % on greenfield sites |

| Sites identified in Hastings Local Plan | 2467 | 72% | 28% |

| Newly identified sites | 2499 | 44% | 56% |

| Total | 4966 | 58% | 42% |

7.13 With the exception of the Ore Valley Millennium Communities site, there are no major opportunities for development of a large site (500 units or more) within the built-up area of the town. The potential housing sites tend to be smaller and are spread across the different wards and Area Co-ordination Zones referred to in the table on page 37.

The Delivery Strategy

7.14 We need to manage housing land supply to achieve continuing delivery of housing up to 2026. The proposed major greenfield housing development area at Breadsell Lane in the north west part of the town will be key to ensuring housing delivery over the long term. This is the only major land area outside the boundary of the built up area that is not subject to landscape or nature conservation protection policies.

7.15 The site is capable of accommodating up to 1000 new dwellings, and has been identified for release in the period 2021-2026.

7.16 Hastings Borough Council will release this site before 2021 should monitoring show it to be needed, in line with national policy in Planning Policy Statement 3. The trigger for release of this site before 2021 will be when, and if, housing delivery falls more than 15% below the annual target of 210 units per annum for 3 years in a row.

7.17 Traffic modelling to test the impact of different development scenarios, including this option, on the Link Road is being undertaken.

The Preferred Approach – The Re-Use of Previously Developed Land

7.18 By directing the majority of housing development to sites within the boundary of the built-up area boundary, the Spatial Strategy supports Objective 4 of the Vision – ‘Prioritise the Use of Previously Developed Land’

7.19 The re-use of previously developed land is vital to the physical regeneration of the town, and helps to preserve our existing green spaces within the urban area.

(13) PREFERRED APPROACH 2: The Re-Use of Previously Developed Land

To achieve at least 60% of residential development each year on previously developed land.

7.20 This target will be monitored annually and it must be acknowledged that the target will be difficult to reach in the later years of the plan period (post 2021) if the major Greenfield site needs to be released.

Alternatives and Sustainability Appraisal

7.21 We consider the sustainability effects of these approaches and discuss the other alternatives on pages 84 and 85 of the accompanying Sustainability Appraisal Report.

Links

- Issues and Options stage – Questions 6.1, 6.2

- Core Strategy objectives – 2, 4

- Draft South East Plan – SCT 7, H1, H3

- Hastings Local Plan 2004 policies – H1

- Community Strategy targets – 16a, 16b, 16c

- PPGs/PPSs/Circulars – PPS3

Measuring Success

- Annual net housing completions

- Percentage of residential development completed on brownfield land

Employment Locations

The Issues

8.1 Local authorities are encouraged to provide for a full range of economic development needs, to support the retention of employment, enable expansion and to create opportunities for inward investment and new uses. National guidance states, “planning authorities should aim to ensure that there is sufficient land available which is readily capable of development and well served by infrastructure. They should also ensure that there is a variety of sites available to meet differing needs”.

8.2 The Draft South East Plan defines Hastings as a Regional Hub; a centre for economic activity and transport services. It defines Hastings as a Secondary Regional Town Centre, part of a network of Strategic Centres, and a focus for: retail, cultural activities, tourism, employment and large-scale office development.

8.3 It also requires councils to find ways of diversifying the economic base of the coastal resorts, while upgrading facilities to promote higher value activity, and support urban regeneration. The Draft South East Plan’s priority is to pursue and promote sustainable economic growth and regeneration. The aim is to raise the sub-regional economy up to the South East average, and to help regenerate the local economy, the draft Plan in particular requires local authorities to:

- protect existing and allocated employment sites from other uses unless they are demonstrated to be incapable of meeting the needs of business

- develop and co-ordinate with other agencies delivery mechanisms to unlock and implement sites with economic development potential.

- be prepared to permit mixed use schemes on existing or allocated employment sites in circumstances where this would deliver necessary employment space at the right time on sites which would be unviable for an employment only scheme, and

- try to improve and up-grade existing industrial estates and business areas to bring them up to the modern standards required by business.

8.4 The Draft South East Plan also sets out the process for identifying the employment needs of the area based on the needs of the local economy and workforce, and then sets a sequential test for the allocation of sites, with the smarter use of town centres as part of mixed use schemes being the preferred option, then the more effective use of existing sites, and then in certain special circumstances, a limited release of land subject to environmental constraints.

8.5 The South East England Regional Development Agency (SEEDA) has identified Hastings and Bexhill as a key regeneration priority.

You Told Us – Results of Issues and Options Consultation

8.6 28% of respondents felt that Hastings has sufficient employment land of the right quality and in the right locations to support employment growth to 2026, 35% disagreed and 37% had no opinion.

The Preferred Approach – Employment Locations

8.7 Employment sites in Hastings either allocated, or with outstanding permissions, have scope to provide a total of 95,200m² of floorspace.

8.8 The development of a number of these sites form part of a major regeneration programme co-ordinated and implemented by the Task Force. The aim of these projects is to attract new businesses to the town and stimulate growth in under-represented sectors, by creating a step change in the quality of business space available.

(21) PREFERRED APPROACH 3: Employment Locations

In line with the town’s identification as a priority focus for economic regeneration and its role as a regional hub, the Council consider that employment-related development should be concentrated within Hastings Town Centre, within the town’s established industrial estates, on land already identified for employment related development and as part of mixed employment/housing development on suitable strategic sites.

Main locations and estimated date of development

Hastings Town Centre - Office employment

8.9 The Hastings office market is relatively undeveloped. The town does not have a commercial central core of traditional office space of any significant size.

8.10 The quality of space available in the town centre will change markedly with the completion of Lacuna Place, a Task Force initiative currently underway and due to be completed in 2008. Lacuna Place is a key element in the wider regeneration area known as Priory Quarter.

8.11 Priory Quarter area incorporates University Centre Hastings (UCH) and the Creative Media Centre, as well as Lacuna Place, and will provide a business and education quarter within the Town Centre. The Priory Quarter development is being delivered by The Task Force on behalf of the Task Force as part of its wider business plan for regeneration. The development strategy is that the early phases of development will be supported by public funding, with the later phases being achieved through the private sector on the basis of increased investor confidence in the area. Inevitably, delivery of the project will become increasingly dependent on market conditions as it moves into later phases.

8.12 The next phase will be on the site of Queensbury house and is targeted to be completed during 2011/12. The whole of Priory Quarter will take a number of years to complete and will be very much subject to market conditions, however, the currently projected timescale for completion is 2016. The timetable below sets out the anticipated developments:

| 2008 | Lacuna Place phase 1 | 3,981m² |

| 2008 | Lacuna Place phase 2 | 4,904m² |

| 2011/12 | Queensbury House site | 4,810m² |

| 2016 | Remainder of Priory Quarter | 18,150m² |

8.13 Total net office floorspace derived from the schemes amounts to 31,845m².

8.14 The opportunity to provide additional office floorspace, as part of a comprehensive development scheme on the seafront adjacent to Pelham Crescent, will be explored towards the later part of the Plan period.

Existing employment areas

8.15 There are five established industrial estates in Hastings, namely the Castleham, Churchfields, Ponswood, Ivyhouse Lane and West Ridge/Ashdown estates. In addition, there are further smaller concentrations of floorspace in employment related uses, located outside of the main five estates at various locations throughout the town. All of these areas play an important role in providing business locations and employment opportunities for local firms and local people. The strategy for these locations will be to maintain them as locations for new businesses and those needing to expand.

8.16 Allocated infill sites in the main employment areas (primarily at Churchfields) have the scope to add some 17,500m² of new floorspace. This could accommodate a range of higher quality unit development, ranging from small start-up units to larger units. We envisage that these sites will be brought forward by the private sector over the lifetime of the plan.

8.17 There is also scope to provide new floorspace through the redevelopment of outdated industrial premises. To encourage renewal and attract commercial investment (with better returns), a higher density of development (intensification) in employment areas (e.g. 2 or 3 storey) will be encouraged. We will also adopt a more flexible approach to the redevelopment of the older/outmoded industrial areas, encouraging a mix of employment-generating uses. It will be for the forthcoming Site Allocations Development Plan Document, which will be prepared as part of the LDF, to explore both of these options in detail and to identify locations where this approach will be suitable.

Major development areas

8.18 In addition to the major office development planned for Hastings town centre, and in order to support regeneration initiatives, we want to retain and carry forward the major employment allocations in the existing Local Plan. Combined, these existing allocations have the potential to provide for some 42,000m² of floorspace for office/B1, B2 or B8 uses. All of these sites are relatively well located, close to or adjoining existing employment areas, with good road links, potentially well located in terms of public transport links and close to existing areas of population. Three of these site fall within the Enviro Enterprise Corridor, with a further site located at Ivyhouse Lane.

Enviro Enterprise Corridor

8.19 Land at Queensway, known as Queensway South and Queensway North, will be brought forward by The Task Force. Together these sites will form the Enviro21 Innovation Parks. Queensway South with be developed first and current plans include the development of circa 8,835m² of floorspace for light manufacturing use with office space. Additional ancillary facilities will also be developed at this location. The first phases are expected to be completed in 2009. Later phases including land at Queensway North (9,700m²) are expected to follow during 2011-13.

8.20 It is important to note that the majority of the recent and on-going employment related development schemes have or will benefit from some type of public subsidy to bring them forward. The success of these early schemes will be critical to the phasing and implementation of the remaining development areas, which are reliant on private sector investment. Options for bringing the remaining sites forward at Queensway/West Ridge and Ivyhouse Lane will be explored through the forthcoming Site Allocations DPD. Development at Queensway/West Ridge will be dependent on the route and timing of the Baldslow Link between Queensway and the A21.

North East Bexhill relationship

8.21 The regeneration efforts in Hastings also need to be considered in relation to the impact of development outside of the town. Most significant here is the northeast Bexhill proposal in Rother district. This is a major development area aiming to provide some 50,000m² of commercial development on land to the north of Bexhill to either side of the proposed link road. Timing of development will largely be driven by progress with the Hastings – Bexhill Link Road, due for completion in 2011. As a major land release, development at northeast Bexhill will take place over a number of years and the pace of development will be influenced by market conditions.

8.22 It has the scope to meet the needs of both local and in-moving occupiers. The regional hub concept promotes large population centres as appropriate locations of strategic growth given their role as employment, service and transport centres. Bexhill plays a complementary role to that of Hastings’ Hub status by providing opportunities for employment development as part of urban extensions on a scale not possible within the constrained urban area of Hastings. North East Bexhill represents the most important new land release within the Hastings - Bexhill area.

Sustainability Appraisal

8.23 No alternative employment locations were considered.

8.24 We consider the sustainability effects of this approach on page 85 of the accompanying Sustainability Appraisal Report.

Links

- Issues and options stage – Questions 8.1 to 8.5

- Core Strategy objectives – 1, 3, 4

- Draft South East Plan – CC1, TC2, RE2, RE3, TSR1, SCT1, SCT3

- Hastings Local Plan 2004 policies – E1, E4, New policy

- Community Strategy targets – 7, 8

- PPGs/PPSs/Circulars – PPS1, PPS3, PPS6, PPS12, PPG4

Measuring Success

- Percentage of employment development floorspace completed on brownfield land

- Number of VAT registration/deregistrations and net change in stock

- Total employment floorspace completions

- Vacancy rates in employment areas.

- Number of VAT registered businesses

Location Of Retail Development

The Issues

9.1 The 2006 Knight Frank study on the retail needs of the town up to 2021 identified a number of issues:

- The vast majority of retail floorspace need will be for comparison goods (clothing, footwear, household and recreational goods).

- In order to retain its market share, Hastings Town centre would need approximately 15,560m² of net additional comparison goods floorspace in the period 2011 to 2021. This is equivalent to gross 24,000m² and if allowance is made for related service trade shops (e.g. restaurants, coffee bars, hairdressers, travel agents etc) the figure increases to 30,000m². This is roughly equivalent to a second Priory Meadow development.

- If this scale of development does not take place in Hastings town centre, its position in the regional shopping hierarchy will deteriorate. Immediate competitors such as Eastbourne and Tunbridge Wells will absorb an even greater share of the spending of Hastings and Bexhill residents.

- The need for additional convenience goods floorspace (everyday essential items including food, drink, newspapers, confectionery) will be minimal.

- The need for retail warehouse floorspace (electricals, DIY, furniture etc) between 2011 and 2021 would be approximately 8200m² net (equivalent to about gross 9050m²).

- There could be up to 1300 jobs from the growth of retailing up to 2021, if all the retail capacity identified in the study is met.

9.2 A central objective of government planning guidance is the promotion of viable and vital town centres – “development should be focused on existing centres thus strengthening them, and if necessary regenerating them”. For Hastings, this would locate the majority of development in Hastings Town Centre.

You Told Us – Results of Issues and Options Consultation

9.3 65% of respondents thought that we should seek to accommodate as much as possible of the forecast future needs for retail floorspace in Hastings Town Centre, 20% disagreed with this, and 15% had no opinion.

The Preferred Approach – Location of Retail Development

9.4 The Council has considered 3 strategic options for the location of new comparison goods floorspace (town centre, edge-of-centre, out-of-centre).

(21) PREFERRED APPROACH 4: Location of Retail Development – Comparison Goods

To locate the majority of required 30,000 m² of additional comparison goods floorspace in Hastings Town Centre, with an element of new provision located in St Leonards District Centre. Site identification for Hastings town centre would be undertaken as part of the Site Allocations DPD. The development would be undertaken by the private sector, and the Council would use its compulsory purchase powers to assist in land assembly where necessary. The development would be phased to occur in the 2016 – 2026 period.

If for any reason the retail needs to 2026 cannot be accommodated in the town centre, then the Council will pursue a sequential approach to site selection, looking first for potential sites on the edge of the town centre, and then at out-of-centre sites

9.5 This is a sustainable approach in that it would support the retail role of the two centres, both locations are more accessible by foot and by public transport than out-of-centre locations, and would generate prime shopping frontage and meet the needs of retailers.

9.6 The Council does not consider town centre locations to be suitable for retail warehousing. Therefore the Council’s preferred approach is as follows:

(10) PREFERRED APPROACH 5: Location of Retail Development – Retail Warehousing

To locate 9000m² of retail warehousing on edge-of-centre sites or out-of-centre sites, which are well served by a choice of means of transport between 2011 and 2026. Suitable sites will be identified through the Sites Allocation Development Plan Document.

The Preferred Approach - Town, District and Local Centres

9.7 It is important the vitality and viability of existing centres in the Borough are safeguarded and enhanced. The network of centres has an important role to play in delivering sustainable and inclusive communities, providing access to shops, offices, community facilities and leisure.

(16) PREFERRED APPROACH 6: Town, District and Local Centres

The following hierarchy of town, district and local centres as identified in the 2006 Retail Capacity Study will be used in the LDF

Town Centre: Hastings

The principal centre in the Borough

District Centre: St Leonards centre

Ore Village

Groups of shops often containing at least a supermarket and a range of non-retail services such as banks, building societies, restaurants, as well as public facilities such as a library

Local Centre: The Old Town

Silverhill

Bohemia

A range of small shops of a local nature, serving a small catchment – could include a small supermarket, a newsagent, sub post office, laundrette etc.

Development proposals for town centre uses will be focused within the town and district centres. The scale and type of development will reflect the centre’s existing and proposed function and its capacity for new development. A proposal for a town centre use will be required to follow the assessment approach set out in PPS6 in terms of need, scale, sequential approach to site selection, impact on other centres, including those beyond the Borough boundary, and accessibility.

The vitality and viability of the town and district centres will be maintained and, where appropriate, enhanced. Measures will include:

- Safeguarding the retail character and function of the centre;

- Enhancing the appearance, safety and environmental quality of the centre;

- Encouraging diversity of uses within the centre and the provision of a wide range of retail, leisure, social, education, arts, cultural, office, residential and commercial uses;

- Promoting the reuse of vacant buildings; and

- Maintaining and enhancing access to the centre by sustainable modes of transport, and encouraging multi-purpose trips.

In partnership with other agencies, the Council will protect and enhance local centres to better service the local community. If a local centre ceases to function, the Council will consider rationalisation of its role as a centre, or promotion of other uses.

Neighbourhood shops located outside the Borough’s centres will be protected where they are important to the day-to-day needs of local communities.

Sustainability Appraisal

9.8 We consider the sustainability effects of these approaches on page 85 and 86 of the accompanying Sustainability Appraisal Report.

Links

- Issues and options stage – Questions 8.25, 8.26

- Core Strategy objectives – 3,4,5

- Draft South East Plan policies – TC1, TC2, TC3, TC4

- Hastings Local Plan 2004 policies – S4, S5

- Community Strategy targets – N/A

- PPGs/PPSs/Circulars – PPS6

Measuring Success

- Vacancy Rates in the Town, district and local centres from the Retail Survey

- Basic services in local shopping areas

- Amount of retail floorspace completed